The Capital Budgeting Process

Simplify Your Capital Budgeting Optimize Your Capital Allocation

If you’re new to our system, we’re here to guide you through the Capital Budgeting Process. Weissr Capex is designed to help you simplify your budgeting process, optimize capital allocation, and ensure smarter, data-driven decisions. With our platform, you'll align your investment needs with your overall capex strategy, while staying within budget constraints.

With Weissr Capex, you can move away from manual, error-prone processes and adopt a centralized platform that enhances collaboration, compliance, and long-term strategic alignment. By integrating with Capex Strategy and Capital Budgeting modules, the platform maximizes cash flow and ensures your investment decisions support your broader financial goals.

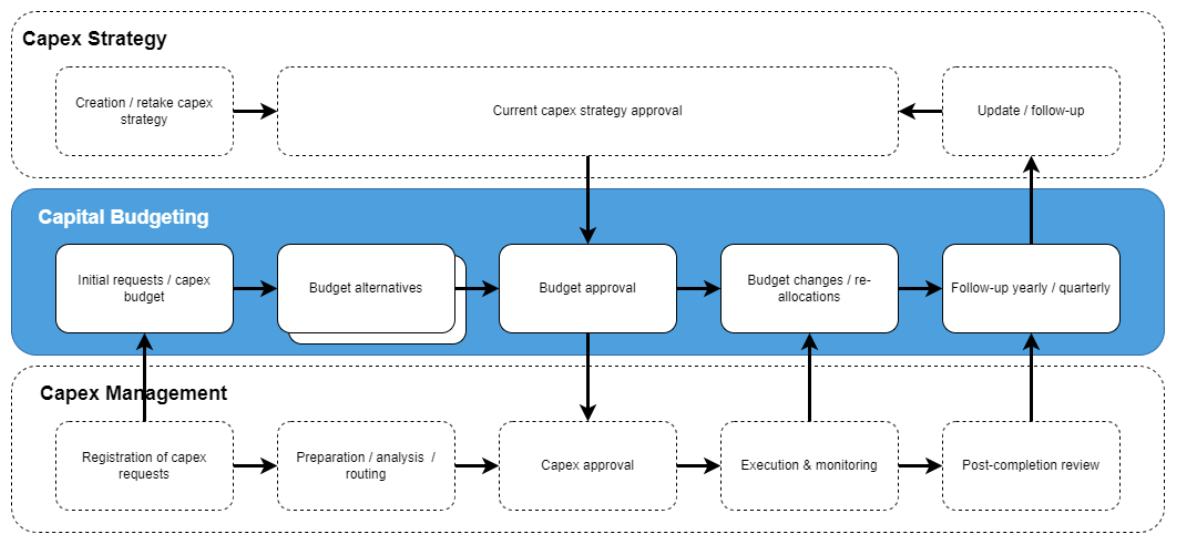

Capital Budgeting Process Overview

Here’s a quick walkthrough of the Capital Budgeting Process in Weissr Capex:

1. Collect and Organize Capex Requests

The capital budgeting process starts with gathering and organizing capex requests from across your organization within the Capex Management Module. Weissr Capex makes it easy to collect detailed project proposals and consolidate them into a single platform. This central collection ensures all relevant information is in one place, allowing you to visualize the investment needs of different departments or units.

2. Build and Adjust Your Budget Portfolio

Once requests are collected, they are organized into an initial budget portfolio. This gives you a clear overview of all capex requests and allows you to allocate resources based on available budgets and strategic priorities. As new information becomes available, you can easily update assumptions and adjust your portfolio to reflect changing circumstances or priorities.

3. Strategic Alignment

Weissr Capex ensures that your capital budget always aligns with your overall capex strategy. This step is crucial for ensuring that your investment decisions support your organization's long-term growth and financial health. By aligning requests with strategic goals, you maximize the impact of every dollar spent.

4. Collaborate and Refine

Capital budgeting is a collaborative process, often requiring input from multiple departments, regions, or units. Weissr Capex enables smooth collaboration across your organization by providing tools for different teams to contribute to the budgeting process in real-time. This helps ensure that all stakeholders are involved and that your budget reflects a comprehensive organizational view.

5. Monitor and Track Your Budget

Once your budget is set and approved, the platform allows you to monitor and track capital expenditures in real-time. You can compare actual spending against budget projections, ensuring that projects stay within their financial limits. If any deviations occur, you can take immediate corrective actions to keep your financial plans on track.

6. Review and Analyze

After capital investments are made, it’s important to evaluate their performance. Weissr Capex provides robust reporting and analytics tools that allow you to review how well your capital budget performed. By analyzing KPIs and historical data, you can gain valuable insights into what worked well and what could be improved for future budgeting cycles.