Investment Model

Investment models in Weissr Capex are essential tools for analyzing the expected cash flow impact of an investment. These models provide a structured framework for financial projections, enabling decision-makers to assess the financial feasibility of requests with confidence and clarity.

Each request is tied to a single investment model selected from the Model Library, which contains customer-specific templates tailored to mirror your organization’s existing Excel-based models.

Key features of investment models

Time resolution and time horizon

Time resolution: Yearly

Time horizon: Flexible, ranging from 5 to 50 years, defined by the system field Analysis period length

Analysis start year: Set using the Analysis Start Year system field — this determines the first year in which cash flow data can be entered

Model structure

Models contain only numerical values (integers and decimals, including percentages)

The first column is used for row labels and cannot be referenced in calculations

Excel compatibility

Models can be exported to and edited in Excel

Users with edit permissions can override default values with Excel formulas

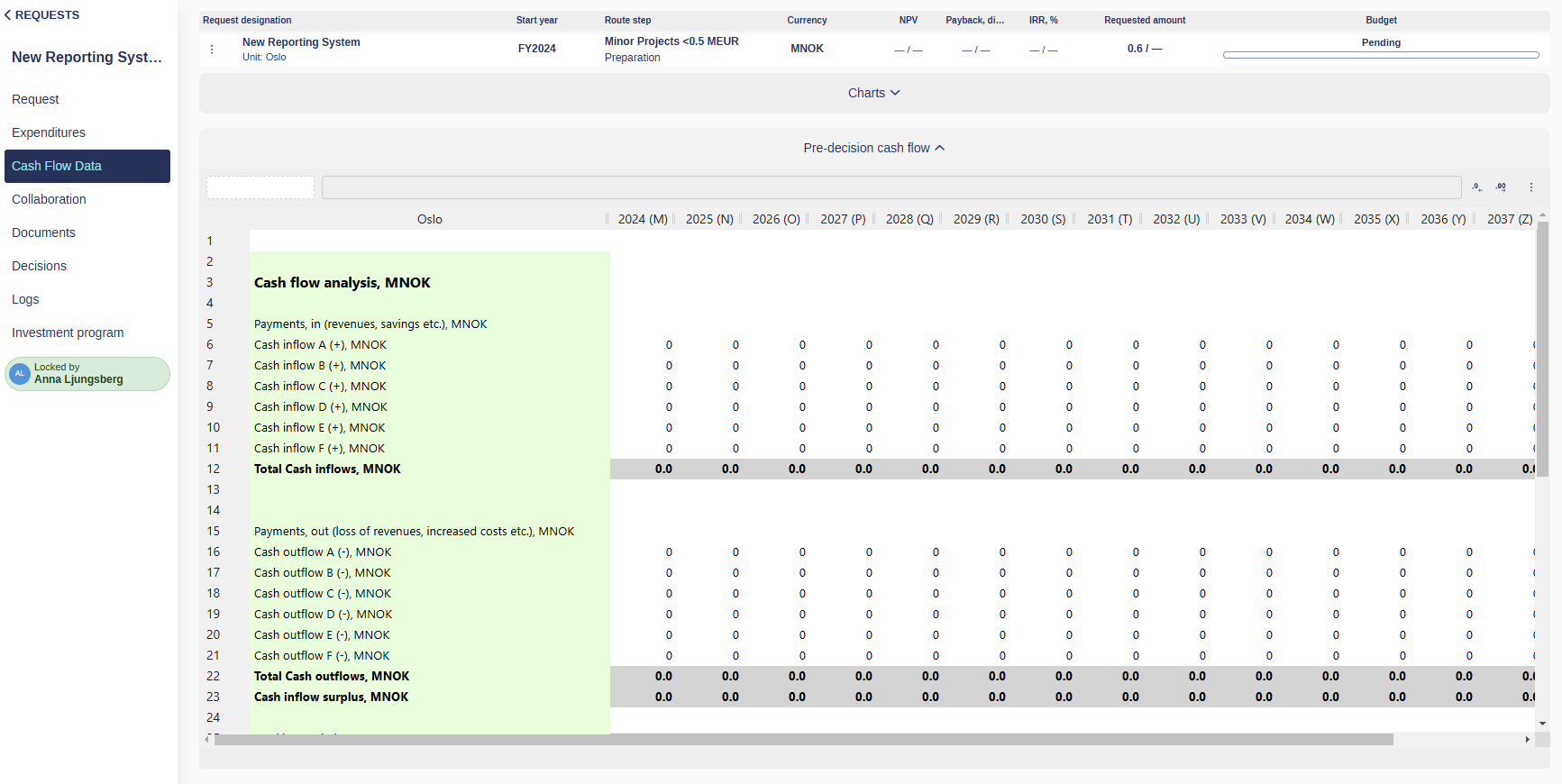

Automatically inserted expenditure data

The investment model automatically reflects financial data entered in the Expenditures section of a request. This automation helps reduce duplication and ensures consistency between sections.

Capex, opex, and totals: Values such as total capital expenditure, total operating expenditure, and combined totals are automatically retrieved and displayed in the corresponding rows of the investment model.

Depreciation calculations: If configured, Weissr can automatically calculate depreciation and related tax impacts, such as the tax shield from depreciation.

These calculations are based on:

Entered expenditure data (e.g., amount, useful life)

Tax rate associated with the production unit

Optional setup: Use of depreciation and tax-related calculations is optional and can be enabled or customized by Weissr consultants during implementation.

Grouping of rows

To simplify navigation in larger datasets:

Rows can be grouped and collapsed/expanded with a click

Configuration of groups is done in the Model Generator by Weissr consultants

Audit and cell log

Weissr maintains a detailed log for every manual data entry in the model, including:

Old and new values

Timestamp of change

Username of the editor

✅ Users with edit rights can view the cell log and restore previous values directly.

Working with the investment model

This section covers essential interactions with the investment model, including how to input data, adjust views, and understand edit restrictions based on workflow phase.

Selecting an Investment model

To work with an investment model, it must first be selected via the Investment model (ID 6) property. Depending on your organization, this property might be named NPV Model, Business Case, or something similar.

If no model is selected, the Investment model tab will not appear in the request.

Model editability by request phase

Certain phases restrict editing in the Investment model:

Project execution phase: The original model becomes un-editable. A Post-Decision model appears instead for ongoing edits.

Post-completion review phase: Both the pre- and post-decision models become un-editable.

Pasting data into the investment model

You can paste data from Excel or other sources directly into the Investment model. using Ctrl+C and Ctrl+V.

Tips

Paste size must match: Ensure the copied range from Excel matches the size of the destination zone.

Number format: Ensure your Excel data does not include blank space as the thousand separator when pasting as this will not recognized as a valid format.

Cut is not supported:

Ctrl+X(cut) does not work in Weissr.Data entry can takes a few seconds to validate and save after each action.

Actions available via right-click

Right-clicking on a cell opens a menu with several key functions:

Copy

Use Copy to duplicate a value or formula. This can also be done with Ctrl+C.

✅ The copied content can then be pasted elsewhere within the Investment model.

Delete values

Use Delete values to remove the content of a cell — whether it’s a static value or a formula. The cell will be cleared and treated as empty. You can also use the Delete or Backspace key to perform this action.

⚠️ This is different from resetting: delete removes the current content entirely without reverting to any original value.

Reset cells

Use Reset cells to revert one or more cells to their original hardcoded values.

✅ This restores the original data, which is typically set when the model was first created.

Copy to End

Use Copy to End to apply the value of the selected cell across the entire row.

✅ All cells to the right in the same row will be filled with the selected value.

Add comment / Delete comment

Use Add comment to attach a note to a cell. To remove a comment, right-click the same cell and select Delete comment.

📌A small black triangle in the top-right corner of the cell indicates a comment is present.

Refresh

Use Refresh to update the Investment model with the latest data and changes.

💡 This can also be done by refreshing the page in your browser (e.g., using F5 or the browser refresh button).

Importing investment model data

Weissr allows users to import data into an investment model directly from the Investment model tab. This functionality is available both pre-decision and post-decision, depending on the request phase.

Excel format requirements

📄 The imported Excel file must match the structure and layout of the Weissr model. This includes:

Consistent sheet and column naming

Matching cell positions

Compatible number formats

⚠️ Mismatched formatting may result in data not being imported correctly.

Internal vs. external investment models

For more complex use cases, Weissr supports integrating both internal and external models to streamline data management and maintain calculation transparency.

External Excel model

Used for:

Background calculations

Detailed financial references

Advanced logic that may be cumbersome to replicate inside Weissr

Internal Weissr model

Used for:

Aggregated or summarized data

Data display and user interaction within Weissr

🔗 By linking cells or sheets from the external Excel model to the internal Weissr model, users can import up-to-date, calculated data into Weissr while keeping the detailed logic in the background.

💡 This approach is ideal when you need to show high-level summaries in Weissr while maintaining access to full calculations in Excel.

Personal adjustments to the investment model

These options allow you to personalize how data is displayed in the Investment model. While they do not change the underlying data or formulas, they can improve readability and data presentation.

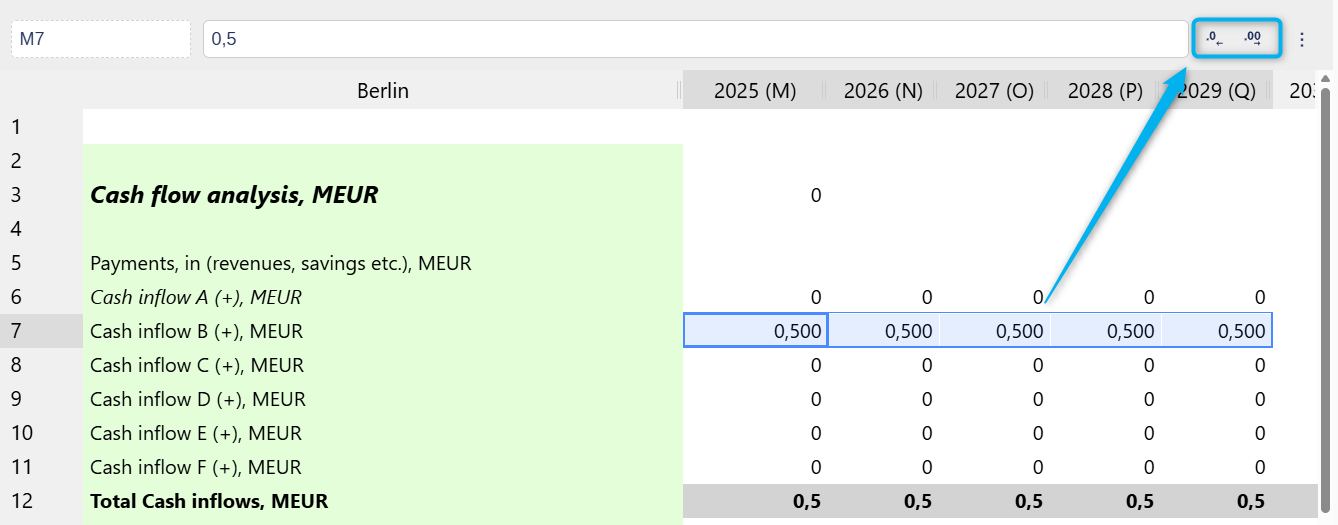

Adjusting the number of decimals

You can change how many decimal places are shown in one or more cells or a whole column for better precision or visual clarity.

Select your cells, or columns and click on the increase or decrease icon to the right of the formula bar.

Changing column width

You can resize columns to make data easier to read or to better fit content.

Hover your pointer over the edge of a column header.

When the resize cursor appears, click and drag left or right to adjust the width.