Key KPIs explained

How are key KPIs in Weissr Capex Management calculated?

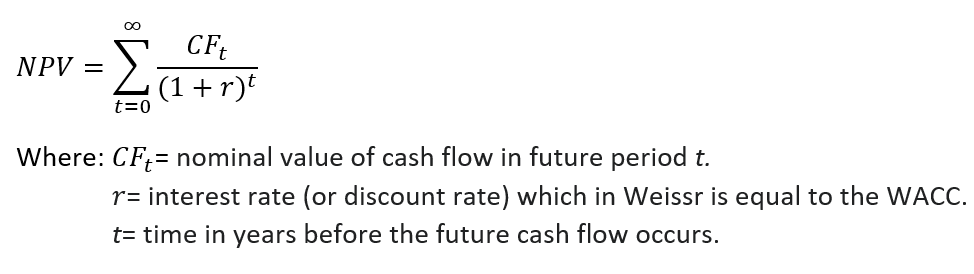

Net Present Value (NPV):

The Net Present Value is the value of all future cash flows (both positive and negative) discounted to the present day. The general rule is that a positive NPV indicates that a project should proceed whilst a negative NPV indicates that a project should be abandoned. It is however hard to analyze the profitability of a request from a single KPI and without an influencing overarching strategy. Weissr can therefore use multiple KPIs in combination with strategy information to create a holistic view of the request. The equation below demonstrates how Weissr calculates NPV:

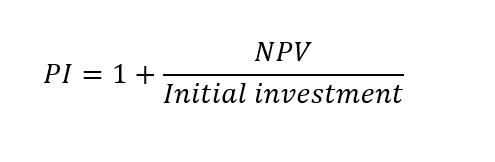

Profitability Index (PI):

The Profitability Index is calculated by dividing the NPV that will be generated by the project by the initial cost of the project. The general rule is that a profitability index or ratio greater than 1 indicates that a project should proceed whilst a profitability index or ratio below 1 indicates that a project should be abandoned. The equation below demonstrates how Weissr calculates PI:

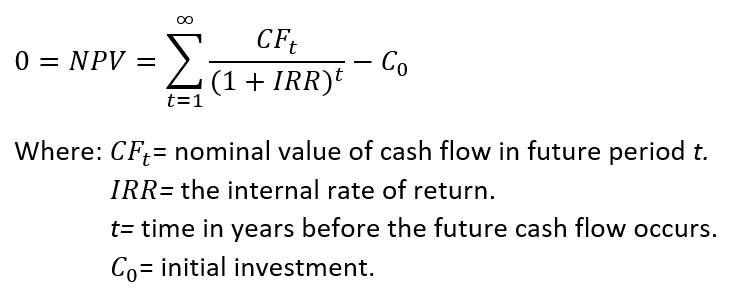

Internal Rate of Return (IRR):

The Internal Rate of Return is the interest rate that makes the NPV of all cash flows from a particular project equal to zero. To put it simple, IRR shows the investments expected future rate of return. IRR is uniform for investments of varying types and, as such, IRR can be used to rank multiple prospective projects on a relatively even basis. To calculate IRR using the equation below, one would set NPV equal to zero and solve for the interest rate, which is the IRR. However, IRR cannot be calculated analytically and must instead be calculated either through trial-and-error or using programmed software. Weissr uses excels formula for IRR when performing these calculations.

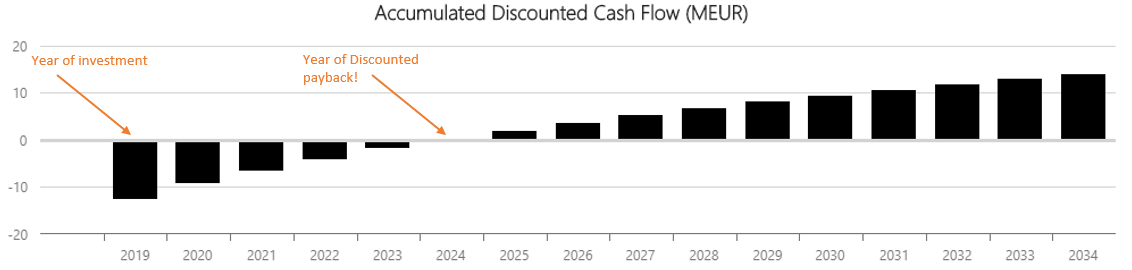

Discounted Payback:

The Discounted Payback shows how many years it takes for an investment to break-even, i.e. Accumulated Discounted Cash Flow = 0. Appose to regular payback calculations, the Discounted Payback recognizes the time value on future cash flows, resulting in more accurate data. The chart below demonstrates how Weissr calculates Discounted Payback (interpolation is used to find the year of payback):