Currencies, Countries & FX Rates

Currencies, countries, and FX rates are essential components in Weissr’s Capex Management, Capital Budgeting, and Capex Strategy modules. While these settings are global across the platform, Capex Strategy allows for custom FX rates to be defined at the project level, offering greater flexibility for specific scenarios.

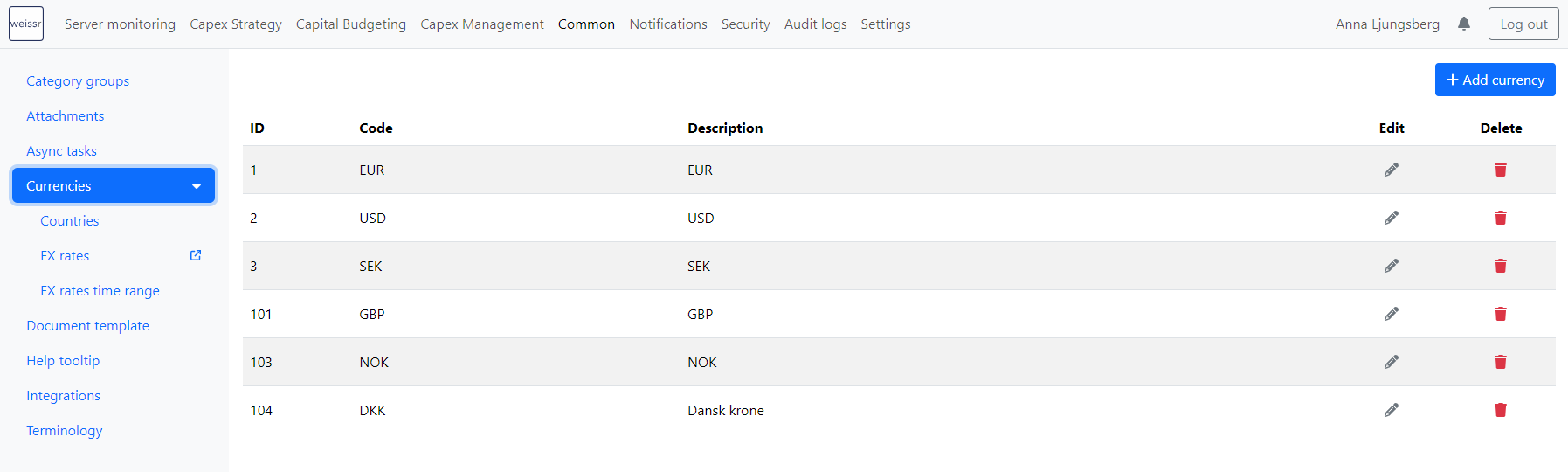

Currencies

Currencies in Weissr are tied to nodes within the Capex Management and Capital Budgeting organizational structure, as well as to the scope in Capex Strategy. The currency assigned to each node determines the local currency in which all financial data will be entered and processed.

Adding or Editing Currencies

To manage currencies in Weissr, follow these steps:

Navigate to Administration → Common → Currencies.

To Add a New Currency:

Click + Add currency.

In the pop-up window, enter the currency code (required) and an optional description in the pop-up window.

Click Save.

To Edit an Existing Currency:

Click the pen icon next to the currency you wish to modify.

Adjust the currency details in the pop-up window.

Click Save.

To Delete a Currency:

Click the trash bin icon next to the currency you wish to remove.

Confirm the action in the pop-up window.

After adding a new currency, it is important to enter the FX rates for that currency. For instructions on manually entering FX rates, see Manually Editing FX Rates.

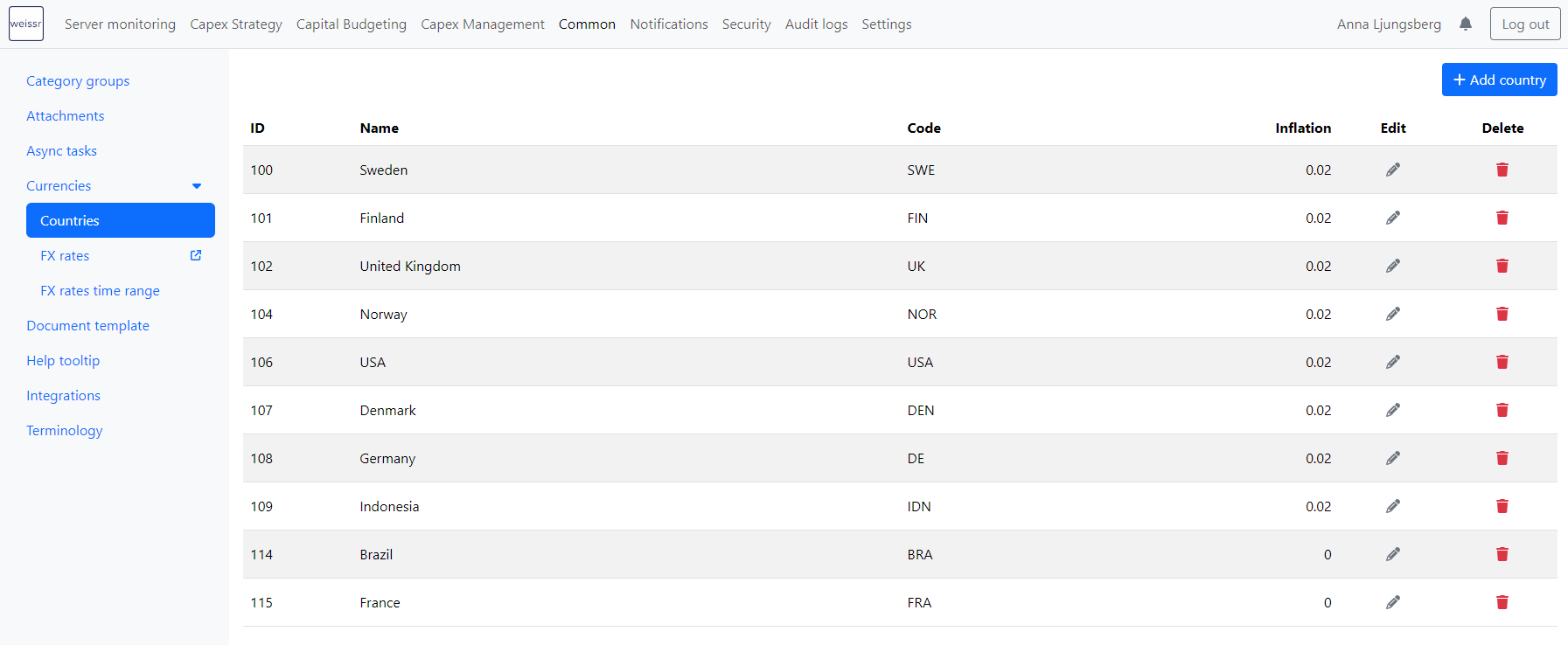

Countries

Countries are linked to nodes in the scope of the Capex Strategy. Countries defined in the common settings can also be used in Capex Management for properties of type "country" which will display the list of countries in a drop-down.

Adding or Editing Countries

Navigate to Administration → Common → Currencies → Countries.

To add a new country, click + Add country.

Enter the country name, country code, and inflation rate in the pop-up window, then click Save.

To edit a country, click the pen icon, update the country details, and click Save.

To delete a country, click the trash bin icon and confirm the deletion in the pop-up window.

The inflation rate is used in Capex Strategy to adjust real values to nominal values for asset-related outlays. It can also be applied in both Capex Strategy and Capex Management to adjust values entered in investment models.

FX Rates

FX (foreign exchange) rates in Weissr can be set on either a monthly or yearly average basis for all available currencies. These settings are applied differently depending on the module in use.

Capex Strategy: If global FX rates are used, the system will apply the yearly average.

Capex Management and Capital Budgeting: You have the flexibility to choose between annual or monthly FX rates. This option is configured in the FX Rate Time Range settings.

When monthly FX rates are used, they convert expenditure outlays in requests and projects from the local currency to the selected currency for reporting and analysis.

Group Currency and FX Rates

All currencies are tied to a primary group currency, usually the company's reporting currency. The group currency has a fixed FX rate of 1, with all other currencies referenced against it.

Examples:

If EUR is the group currency and USD has an FX rate of 1.09, then €1 equals $1.09.

If the FX rate between EUR and SEK is 11.50, this means that €1 equals 11.50 SEK.

These FX rates ensure consistency and accuracy in financial reporting across multiple currencies within the Weissr platform.

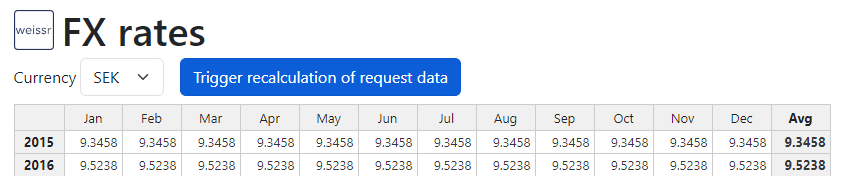

Manually Editing FX rates

You can manage FX rates directly within the application in two ways:

Only users with Administrator or Superuser roles or those with the FX rate (edit or create) can update FX rates

From the Administration Panel:

Navigate to Administration → Common → Currencies → FX Rates.

Select the currency you want to update from the drop-down menu.

Enter the new FX rate for each month in the table, or update the yearly average using annual rates.

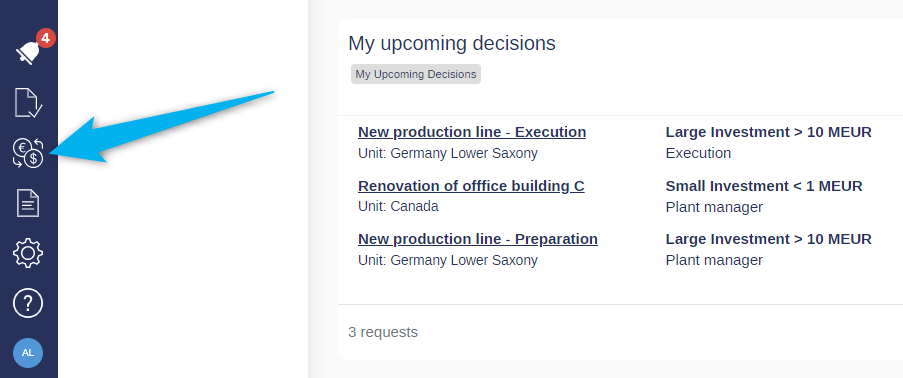

From the Application Sidebar:

If you have the appropriate permissions (create, edit, or read), you can access FX rates from the application's left sidebar menu.

This quick access allows you to review or update FX rates without navigating the administration panel.

Importing FX Rates

Administrators can import FX rates into the system using a .csv file, streamlining the process of updating exchange rates. Importing FX rates automatically triggers a recalculation of all related data based on the new rates, including investment models, expenditures, and requests/projects property data.

For more detailed steps on how to import FX rates, refer to the FX Rate Import Guide.

Trigger Recalculation of Request Data

When FX rates are updated, Weissr automatically recalculates all request and project data to reflect the latest exchange rates. However, if you notice any inconsistencies in currency conversion or calculations—especially after making adjustments like property changes or updates to the organizational structure—you can manually trigger a recalculation of the data.

To manually trigger the recalculation of request data:

From the Administration Panel:

Navigate to Administration → Common → Currencies → FX Rates.

Select the option to Trigger Recalculation of Request Data.

From the Application Sidebar:

If you have the necessary permissions, access the FX Rate Settings from the left sidebar menu within the application.

Select the option to Trigger Recalculation of Request Data.

Only users with Administrator or Superuser roles or those with the FX rate (create) permission can trigger recalculations.

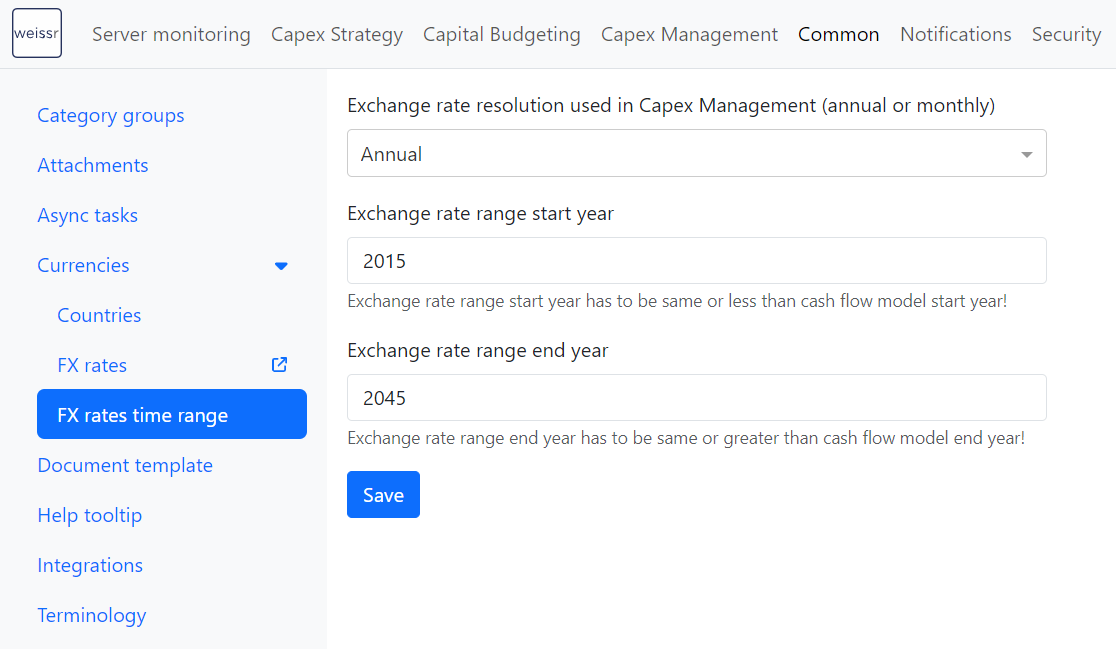

FX Rate Time Range

The FX rate time range determines the start and end years for which FX rates can be entered in the application. It is crucial to ensure that this time range aligns with your project and module settings to avoid discrepancies in currency conversion.

For Capex Strategy: The time range should encompass all the years specified in your project's period settings, from any historical years to the end of the trend period. The latest year in any project within the system should determine the end year for FX rates.

For Capex Management and Capital Budgeting: The time range must cover all configured fiscal years. If you're using all three modules (Capex Strategy, Capex Management, and Capital Budgeting), ensure that the FX rate time range is comprehensive for each module.

Adjusting the FX Rate Time Range

Navigate to Administration → Common → Currencies → FX rate time range.

To change the exchange rate resolution in Capex Management, simply click the drop-down menu and select either Annual or Monthly.

Enter the desired years in the respective fields to update the start or end year of the exchange rate range.