Asset Amount Distribution

Administrators can define Asset amount distributions (AADs) to more accurately model major investments that span multiple years. This feature is particularly valuable for projects like construction and infrastructure, where capital expenditures are rarely confined to a single financial year.

Asset amount distributions are project-specific and define how an asset’s value is spread across a timeline, relative to its in-use year (year 0).

Why use asset amount distributions

By default, Weissr Capex assigns 100% of an asset’s capex value to its in-use year (year 0). While this is sufficient for simple purchases, it often doesn’t reflect the real-world timing of larger or more complex capital investments, especially in construction or infrastructure projects, where expenditures are spread across multiple years.

Using asset amount distributions allows organizations to:

Model multi-year investment flows accurately—for example, spreading costs over the planning, construction, and commissioning phases.

Improve cash flow analysis by allocating percentages of the total capex amount to specific years.

Reuse consistent distribution templates across assets within a project to ensure uniform financial planning.

Maintain compliance with internal policies or external reporting standards that require more granular capex allocation.

Distribution types

Weissr supports three types of Asset amount distributions (AADs). Two of these, Single-year distribution and Manual amount distribution, are available by default, without any setup. All options help you define how an asset’s cost is distributed over time, relative to its in-use year (year 0):

1. Single-year distribution (default)

The full asset cost is applied in year 0

No custom distribution is defined—this is the system’s default behavior when no AAD is selected

2. Manual amount distribution

Enter specific cost amounts per year instead of percentages

The sum of all entered amounts becomes the asset’s total cost

3. Predefined percentage distribution

Allocate the asset’s cost using percentages spread across years relative to year 0

Useful for modeling multi-year investment phases

Example:

10% in year –2 (planning)

30% in year –1 (construction begins)

50% in year 0 (asset goes live)

10% in year +1 (post-completion adjustments)

Key behavior and rules

Defining the distribution grid

The distribution timeline is anchored at year 0, which represents the asset’s in-use year.

You can define percentage allocations for -20 years to +20 years.

Distribution totals and validation

The total distribution must equal 100% to be saved.

Each year’s percentage must be ≥ 0%

Validation feedback is shown if the distribution is invalid or incomplete.

Restrictions on deletion

A distribution cannot be deleted if it is currently used by any asset in the project.

Reinvestment behavior

Reinvestments for assets with a custom distribution type will automatically use the same distribution, but tied to the asset’s replacement year (as defined in the Asset Mapping).

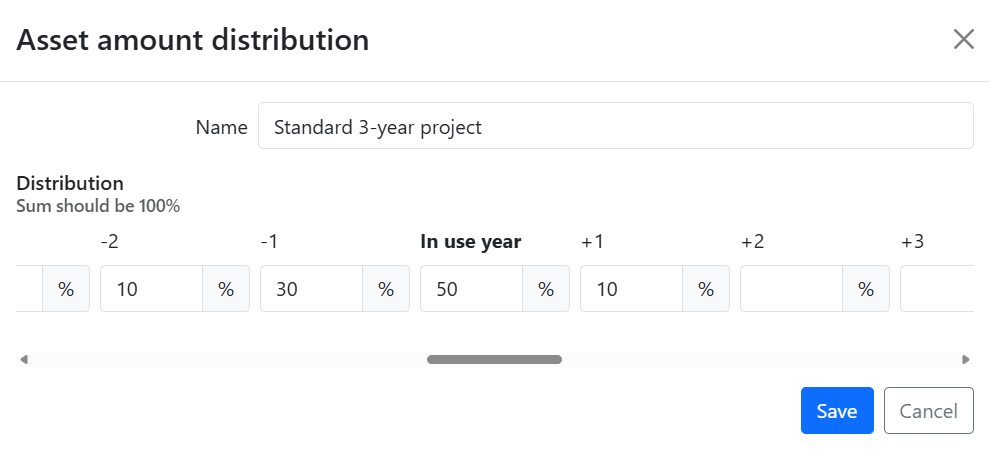

How to create a new asset predefined percentage distribution

Navigate to:

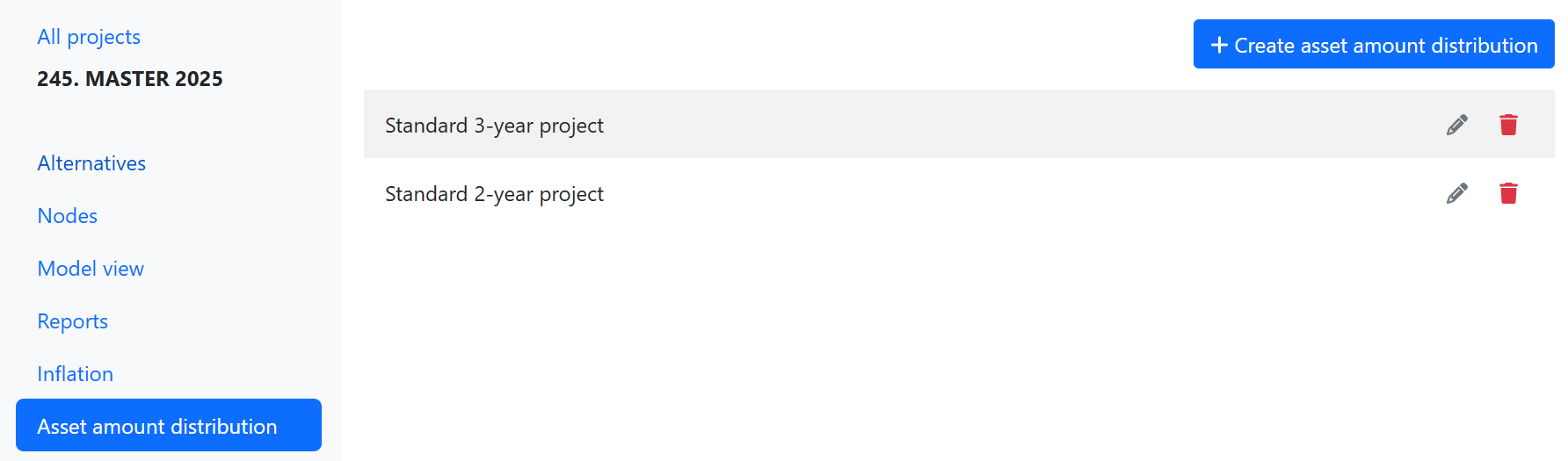

Administration → Capex Strategy → [Project] → Asset amount distributionClick + Create asset amount distribution

Enter a name for the distribution

(This is what users will select in the Asset Mapping interface)Define the percentage allocations across the timeline from year -20 to +20, relative to the in-use year (year 0)

Save once the total reaches 100%

The newly saved distribution type will be available for selection in the Asset Mapping interface immediately.

How to edit an asset amount distribution

To edit an existing distribution, go to the same page and click the pen icon next to the item in the list. You can update the name and adjust the percentage allocations.

Save once the total reaches 100%.

Use case example

In your organization, construction projects often follow a 3-year timeline, with assets becoming operational toward the end of the build phase. To reflect this common pattern, you create a distribution that mirrors typical asset utilization.

For example, you define a custom asset amount distribution named "Standard 3-year project" with the following allocation:

10% in year -2 (project planning and early groundwork),

30% in year -1 (major construction activities begin),

50% in year 0 (assets are fully commissioned and in use),

10% in year +1 (post-completion adjustments and warranties).

This distribution reflects how value is typically consumed over the course of your projects and can be applied across multiple assets for consistency and accuracy in strategic analysis.